Businesses across the country struggling financially because of COVID-19 can now apply for the new commercial rent relief program.

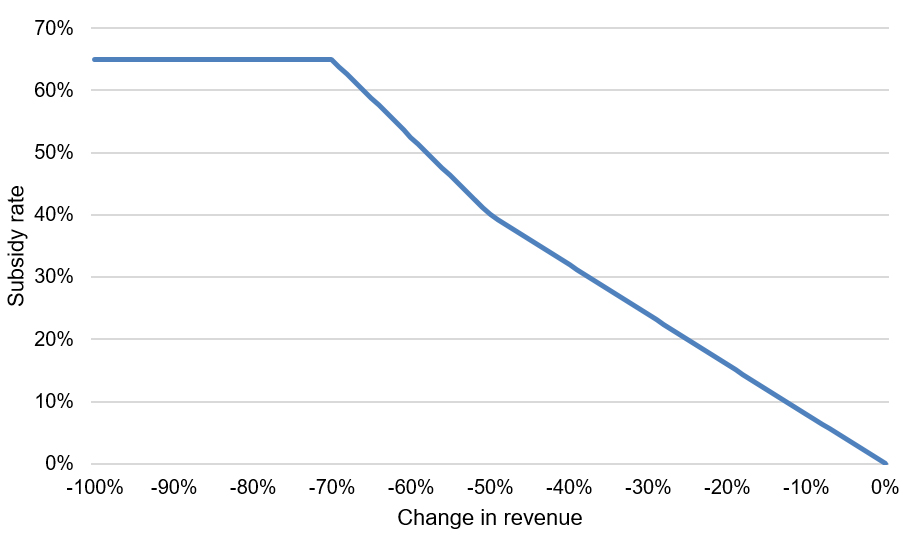

The new federal program covers up to 65 per cent of rent or commercial mortgage interest on a sliding scale based on revenue declines. The more revenue a businesses loses the more relief it can get from the program.

A more comprehensive breakdown of the scale can be found here.

Eligible expenses for businesses to cover include:

- commercial rent

- property taxes (including school taxes and municipal taxes)

- property insurance

- interest on commercial mortgages (subject to limits) for a qualifying property, less any subleasing revenues

The federal government says sales taxes such as GST and PST are not included, and businesses are responsible for calculating their own profit losses and where they fall on the scale, using the formulas on this page.

The program also includes up to 90% rent coverage for businesses who have been ordered to shut down because of public health orders.

Visit the government’s website for more information on how to apply for the subsidy.