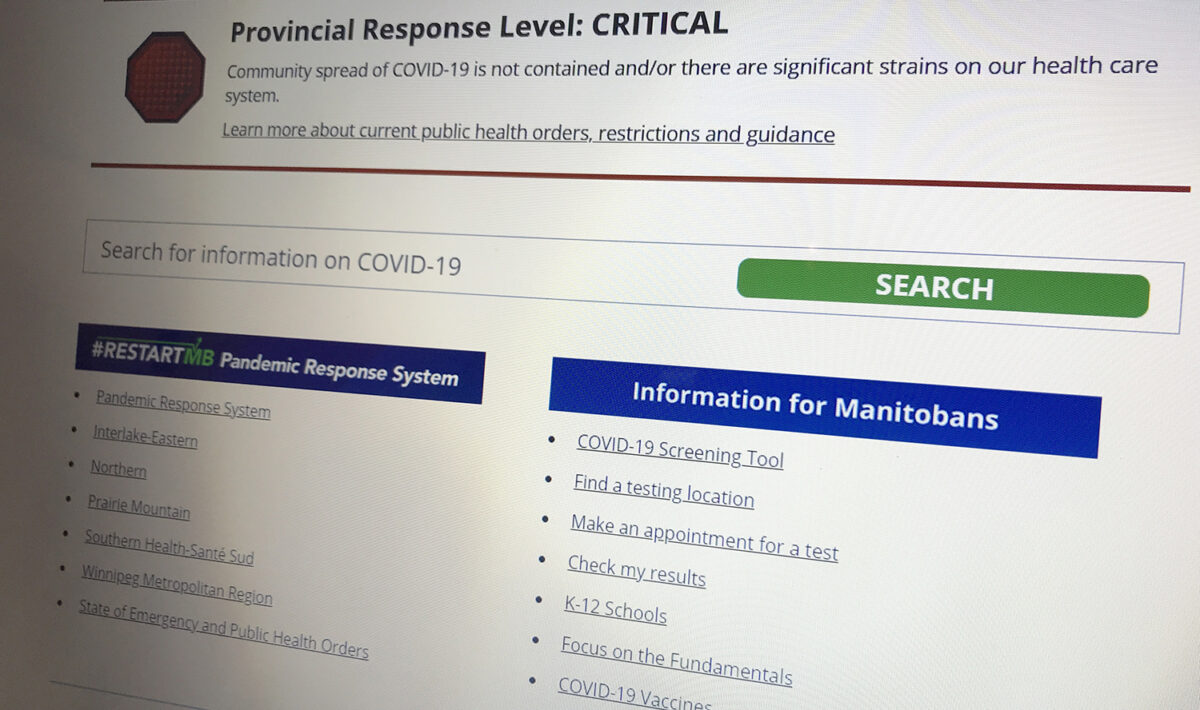

Manitoba’s Premier says the province is extending its support grant for Manitoba businesses for the fourth time.

In a news release, Brian Pallister says the province is increasing its budget for the Manitoba Bridge Grant, which will offer a new round of $5,000 payments to businesses affected by the COVID-19 pandemic.

“We recognize this quick closure for many businesses will have a significant impact on their operations, particularly the restaurant industry who we know were preparing for a busy Mother’s Day weekend,” Pallister said in the new release. “Our government remains committed to delivering the right programs at the right times to help individual Manitobans and businesses through these challenging times.”

A fourth round of payments means the province will provide up to $71 million in financial support to eligible small to medium-sized businesses, not-for-profits and charities impacted by public health measures.

Organizations that received previous payments will automatically receive a fourth payment of up to $5,000 as early as Friday, May 14, 2021. The province will send deposit notifications by email.

The province says in total it has invested $286 million in funding for eligible organizations through the Manitoba Bridge Grant so far.

To find out if your business qualifies for the grant, visit the province’s website.

Additional Supports for Restaurants

In the same news release, the province also announced it is setting up additional supports for the restaurant industry, which Pallister says has been one of the areas the pandemic has hit the hardest.

Those supports include a $2,000 top-up for restaurants in addition to the $5,000 Manitoba Bridge Grant payment to help cover the cost of food waste, employee wages, maintenance or insurance.

The province will also provide an additional $2 million to the Dine-In Restaurant Relief program, which will help restaurants with the cost of shifting their operations toward a delivery model.

“While we urge Manitobans to stay home as much as possible over the next few weeks, we also want to encourage Manitobans to continue to support our many small businesses,” Pallister said in the release. “The best thing we can do for our local business community right now is bend out COVID-19 curve down, so they can get back to doing what they do best, employ Manitobans and offer services Manitobans rely on.”